The fundamental skill of recognising support and resistance is the foundation of the rectangular pricing pattern. It can give you reliable results in a condensed trading window. This guide’s goal is to teach you how to spot patterns and use them effectively when trading on Kotex.

How to recognize the rectangular price pattern

For a moment, let’s discuss the range market. Costs increasing until a certain point and decreasing until a different point. A greater price creates a degree of resistance, and a lower price acts as support. They are sturdy enough to prevent the price from breaking either the resistance or the support when it reaches them.

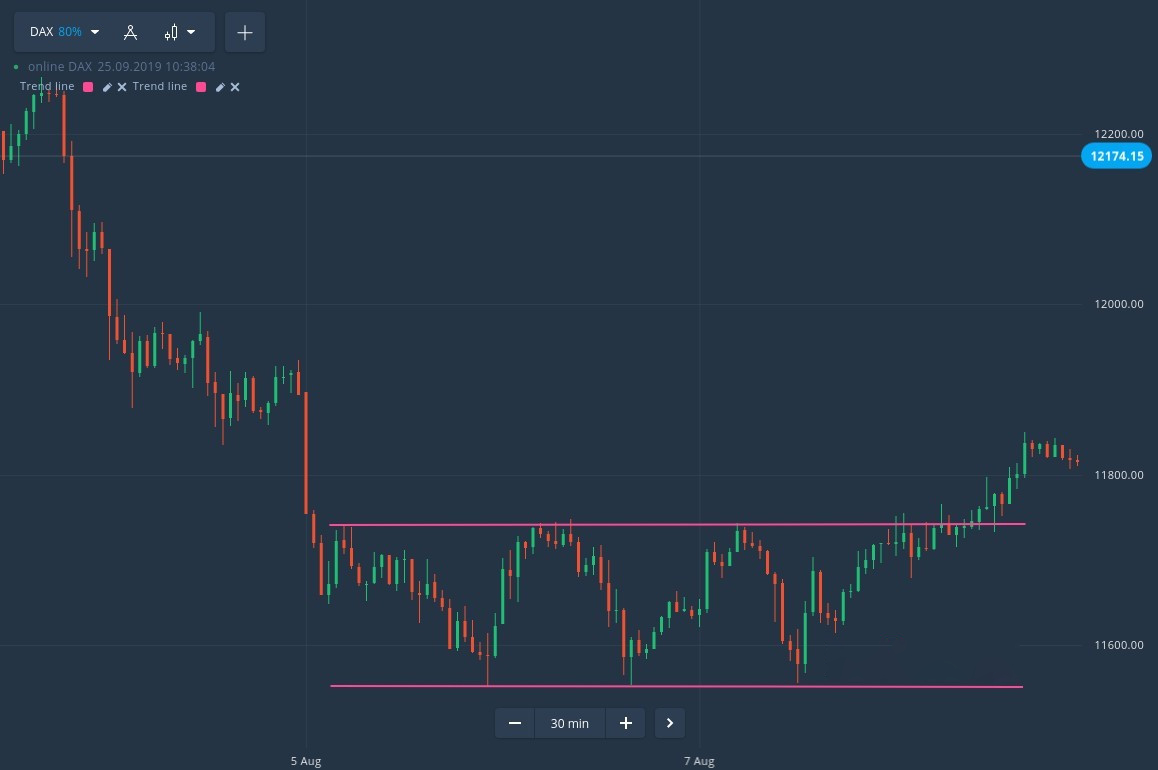

By joining lines that are parallel to one another, support and resistance can be produced. At least two bottoms will be joined to create the support line. At least two vertices will be connected by the resistance line. See the DAX chart for the previous 30 minutes below.

When a trend is ending, the rectangle pattern becomes apparent. This shows that the trend is shifting.

So, the peak or bottom of an uptrend or the middle of a downtrend will be where you can first notice price consolidation. And it is indicating that the trend is about to reverse because the directional movement has ended. Prices at this moment do not fluctuate above or below a specific level.

What to do when a rectangular price pattern appears

A pricing box pattern is typically simple to spot once it has materialised. But do not fret. This will allow you to earn a little before the new trend starts.

You should draw support/resistance lines as your first action. the price touches the lines, look for those moments. Open a buy position when this is the support line. Open a sell position if the resistance line is touched.

For trading shorter time frames, we advise using charts with a bigger time range. Open a 5 minute transaction, for instance, if your trading chart is a 30 minute chart. By doing this, you may be sure that the price will remain within the rectangle and won’t rise before the deal expires.

What to do when the price crosses the support or resistance level

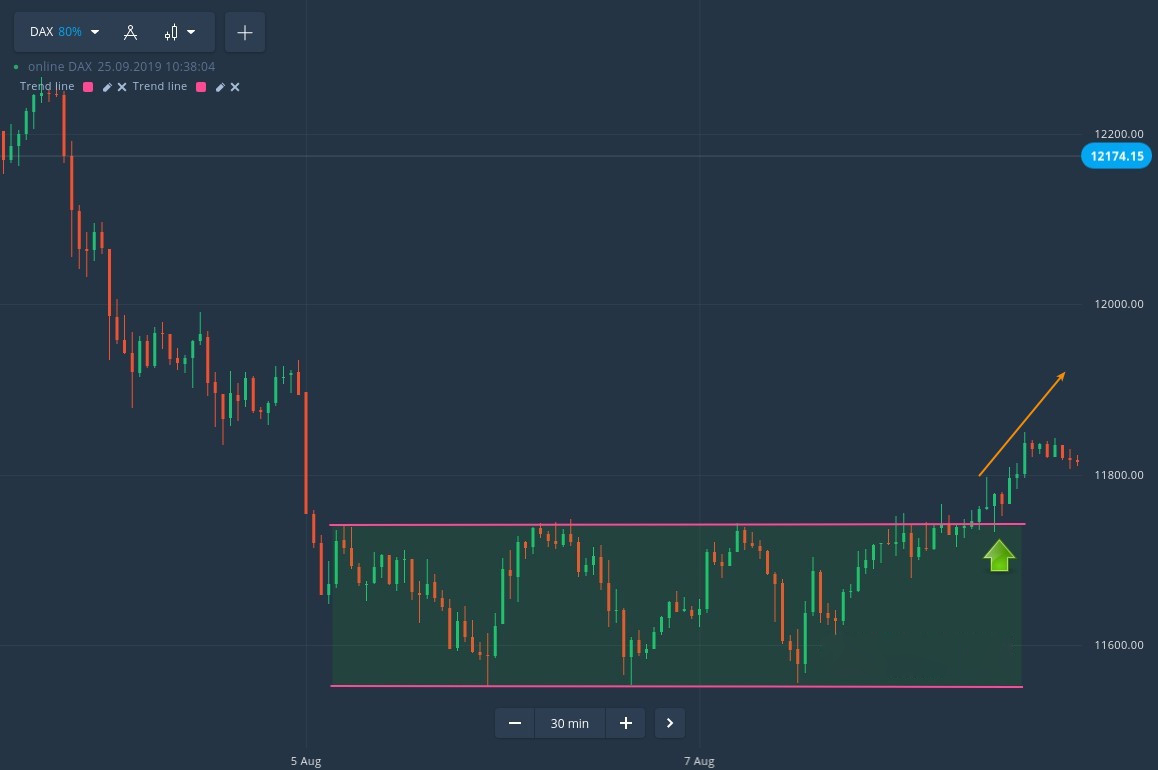

When the price breaks through a support or resistance level, you should be ready. It will happen eventually. Take attention to the price’s direction after the breakout and trade in that direction.

You should open a buy position if the price breaches the resistance level, as shown in our example chart below, as this signals the beginning of an uptrend.

In our guide, you can get more information on trading after price breakouts.

The price fluctuates up and down within a specific range for the duration of the pricing box pattern. Finally, the barrier is broken when the price action is sufficiently powerful. There are several indications that this will go place. Candles, for instance, are tall and the same colour. You should therefore anticipate that the market will keep moving in the breakout direction.

And taking into account everything said above, you can place trades in line with an established pattern.

You can use the rectangle price pattern now that you are aware of it. Before switching to a genuine Kotex account, practise on a free demo account. Be mindful at all times that this tactic is not a foolproof recipe for achievement. Since risk cannot be totally eliminated while interacting with the financial market, you will probably experience losses.

Tell us about your experiences.