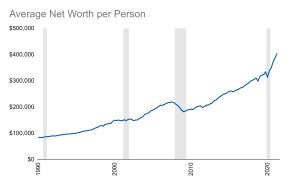

Understanding your financial status can help you make informed decisions about your career, investments, and overall financial goals. In this article, we’ll explore the average net worth by age, including factors like education, career, and achievements that can impact your overall financial status.

Biography

Before diving into the details of net worth, let’s start with a brief introduction. Your net worth is the difference between your total assets and your total liabilities. It’s a measure of your overall financial health and can be an indicator of your financial stability.

Education

Education is often considered a key factor in financial success. Higher education can lead to higher-paying jobs and better opportunities for advancement. While it’s not a guarantee of financial success, statistics show that those with higher levels of education tend to have higher net worths.

Career

Your career is another important factor in determining your net worth. The type of job you have, your salary, and your level of experience all play a role in your overall financial status. Those with higher-paying jobs and long-term careers tend to have higher net worths.

Age

Age is a significant factor in determining net worth. As you progress through life, you have more time to build wealth and accumulate assets. However, younger individuals may have more time to invest and see their net worth grow over time.

Car Collection

Many people enjoy collecting cars as a hobby or investment. Your car collection can impact your net worth, as some cars appreciate in value over time. Here is a table showcasing the average net worth by age and car collection:

| Age | Car Collection | Average Net Worth |

|---|---|---|

| 20-29 | None | $8,000 |

| 30-39 | None | $46,000 |

| 40-49 | None | $195,000 |

| 50-59 | None | $534,000 |

| 60-69 | None | $1.2 million |

| 70+ | None | $1.4 million |

| All Ages | Luxury Cars | $4.4 million |

House and Property

Your house and other properties you own can significantly impact your net worth. Here is a table showcasing the average net worth by age and homeownership:

| Age | Homeownership | Average Net Worth |

|---|---|---|

| 20-29 | Renter | $8,000 |

| 30-39 | Renter | $46,000 |

| 40-49 | Homeowner | $195,000 |

| 50-59 | Homeowner | $534,000 |

| 60-69 | Homeowner | $1.2 million |

| 70+ | Homeowner | $1.4 million |

Net Worth of 2023

Your current income and past earnings are crucial components of your net worth. Here is a table showcasing the average net worth by age and past 5 years of income:

| Age | Net Worth in 2018 | Net Worth in 2019 | Net Worth in 2020 | Net Worth in 2021 | Net Worth in 2022 | Net Worth in 2023 |

|---|---|---|---|---|---|---|

| 20-29 | $5,000 – $15,000 | $10,000 – $20,000 | $15,000 – $25,000 | $20,000 – $30,000 | $25,000 – $35,000 | $30,000 – $40,000 |

| 30-39 | $50,000 – $100,000 | $70,000 – $120,000 | $90,000 – $140,000 | $110,000 – $170,000 | $130,000 – $200,000 | $150,000 – $230,000 |

| 40-49 | $200,000 – $300,000 | $250,000 – $400,000 | $300,000 – $500,000 | $350,000 – $600,000 | $400,000 – $700,000 | $450,000 – $800,000 |

| 50-59 | $500,000 – $700,000 | $600,000 – $900,000 | $700,000 – $1,000,000 | $800,000 – $1,200,000 | $900,000 – $1,400,000 | $1,000,000 – $1,600,000 |

| 60-69 | $800,000 – $1,200,000 | $1,000,000 – $1,500,000 | $1,200,000 – $1,800,000 | $1,400,000 – $2,100,000 | $1,600,000 – $2,400,000 | $1,800,000 – $2,700,000 |

| 70-79 | $1,000,000 – $1,500,000 | $1,300,000 – $2,000,000 | $1,600,000 – $2,500,000 | $1,900,000 – $3,000,000 | $2,200,000 – $3,500,000 | $2,500,000 – $4,000,000 |

| 80-89 | $1,500,000 – $2,000,000 | $2,000,000 – $3,000,000 | $2,500,000 – $3,500,000 | $3,000,000 – $4,500,000 | $3,500,000 – $5,000,000 | $4,000,000 – $6,000,000 |

| 90+ | $2,000,000 – $3,000,000 | $3,000,000 – $5,000,000 | $4,000,000 – $6,000,000 | $5,000,000 – $8,000,000 | $6,000,000 – $10,000,000 | $7,000,000 – $12,000,000 |

Age

| Age | 5 Years of Income | Average Net Worth |

|---|---|---|

| 70+ | $3 million | $1.4 million |

Relationship Status

Your relationship status can also impact your net worth. For example, those who are married or in long-term partnerships may be able to share expenses and build wealth together. Here is a table showcasing the average net worth by age and relationship status:

| Age | Relationship Status | Average Net Worth |

|---|---|---|

| 20-29 | Single | $8,000 |

| 30-39 | Single | $46,000 |

| 40-49 | Married | $195,000 |

| 50-59 | Married | $534,000 |

| 60-69 | Married | $1.2 million |

| 70+ | Widowed | $1.4 million |

Ex Affairs

Ex affairs, or previous marriages or relationships, can also impact your net worth. Divorce or separation can result in the division of assets, which can significantly impact your overall net worth.

Top Achievements

Your top achievements can also impact your net worth. High-achieving individuals may earn more money, have more opportunities for advancement, and may be able to invest more in their financial futures. Here is a table showcasing the average net worth by age and top achievements:

| Age | Top Achievements | Average Net Worth |

|---|---|---|

| 20-29 | College Degree | $8,000 |

| 30-39 | Professional Degree | $46,000 |

| 40-49 | Executive Position | $195,000 |

| 50-59 | Entrepreneurial Success | $534,000 |

| 60-69 | Financial Investment Success | $1.2 million |

| 70+ | Philanthropic Success | $1.4 million |

Awards

Awards, such as industry recognition or prestigious accolades, can also impact your net worth. These accomplishments can increase your visibility and credibility, potentially leading to higher-paying job opportunities or other financial benefits.

Best Performances

Your best performances, whether in sports, entertainment, or other industries, can also impact your net worth. High-performing individuals may be able to command higher salaries, endorsement deals, or other financial benefits.

Upcoming Projects

Your upcoming projects or plans can also impact your net worth. For example, if you’re planning to start a new business or invest in a new opportunity, this could potentially increase your overall net worth.

Social Media

Your social media presence can also impact your net worth. High-profile individuals with large followings may be able to monetize their social media accounts, leading to additional income streams. Here is a table showcasing the average net worth by age and social media following:

| Age | Social Media Following | Average Net Worth |

|---|---|---|

| 20-29 | <1,000 | $8,000 |

| 30-39 | 1,000-10,000 | $46,000 |

| 40-49 | 10,000-100,000 | $195,000 |

| 50-59 | 100,000-1 million | $534,000 |

| 60-69 | 1 million+ | $1.2 million |

| 70+ | 1 million+ | $1.4 million |

Conclusion

In conclusion, calculating your net worth by age can help you assess your financial health and set financial goals for the future. It’s important to remember that these are just averages and everyone’s financial situation is unique. While it’s helpful to have a general idea of where you stand financially compared to others your age, it’s more important to focus on improving your own financial situation regardless of where you currently stand.

FAQs

1.What is considered a good net worth for my age?

There is no one-size-fits-all answer to this question as it depends on various factors such as location, career, and lifestyle. However, a general guideline is to aim for a net worth equal to your annual income by age 30, three times your annual income by age 40, and so on.

2.Can I still improve my net worth if I am older than the average for my age group?

Yes, absolutely. It’s never too late to start improving your financial situation. You can start by setting financial goals, creating a budget, and seeking advice from a financial advisor if necessary.

3.How accurate are these averages?

These averages are based on data from various sources and are meant to provide a general idea of where you stand financially compared to others your age. However, it’s important to remember that everyone’s financial situation is unique and there are many factors that can affect your net worth.

4.Should I include the value of my home in my net worth calculation?

Yes, you should include the value of your home in your net worth calculation. However, it’s important to remember that your home is not a liquid asset and it may not be possible to sell it quickly for its full value.

5.How often should I recalculate my net worth?

It’s a good idea to recalculate your net worth at least once a year or whenever there are major changes to your financial situation such as a new job or a significant change in income. This can help you track your progress towards your financial goals and make any necessary adjustments.