Leverage in CFD trading

Leverage is a unique instrument that you can utilize while trading CFDs with Pocket Option. Traders borrow additional money from brokers in order to make it work.

Traders can invest more money than they actually have by utilizing leverage. This is a fantastic opportunity, but it also carries a substantial risk. Because you lose more money as well as make more of it. Therefore, utilize it with caution and stay away from unpredictable market periods.

Leverage in action

I’ll demonstrate how leverage functions with the examples.

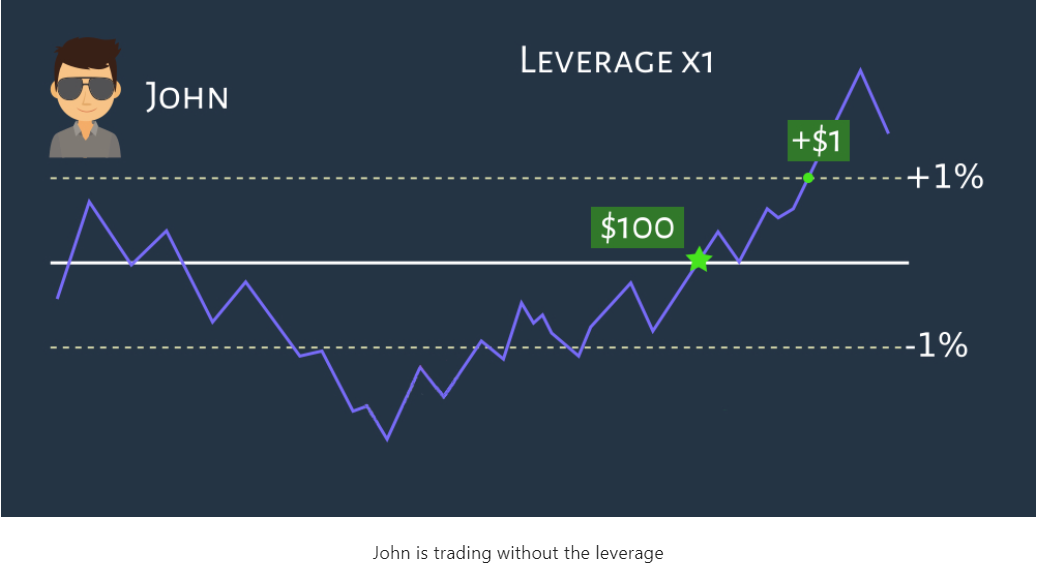

Our merchant’s name is John. He invests $100 to start a CFD transaction. He predicts a rise in the price.

He opts against using leverage. Therefore, the chances are equal. His profit will grow by the same amount if the share price rises by 1%. He made $1 thanks to a successful trade.

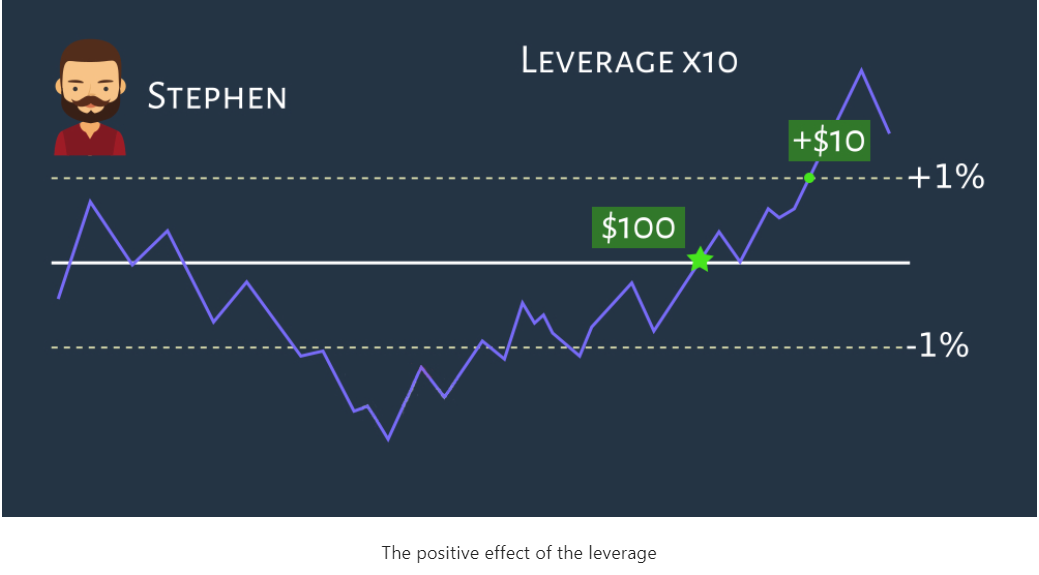

Another entrepreneur by the name of Stephen. He starts the identical transaction and contributes $100.

The fact that he opted to use 1-10 leverage is a another story. This implies that a 1% increase in the share price will result in a 10% increase in earnings. He just earned $10 in profit.

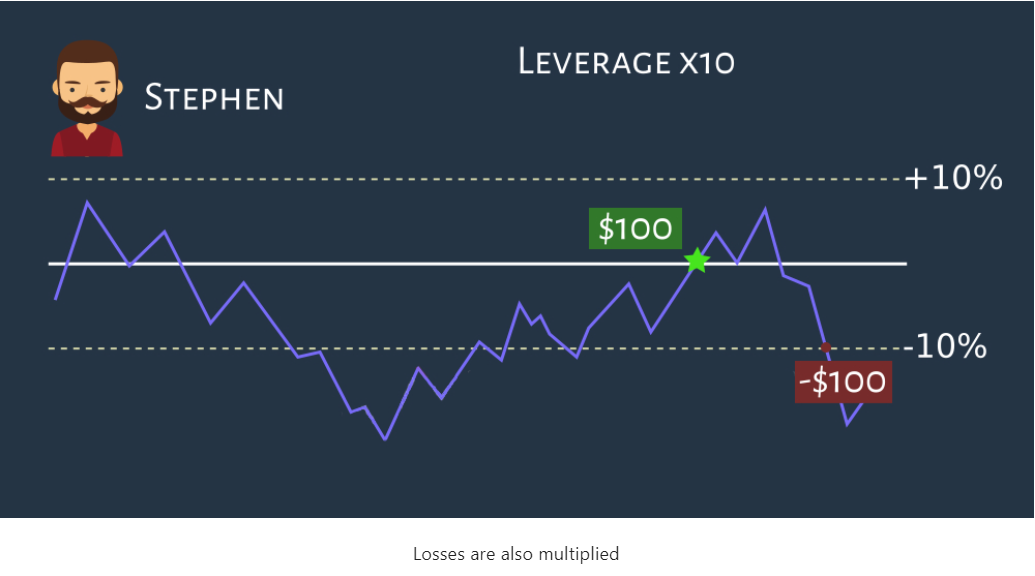

What if the price doesn’t fluctuate in the manner you anticipated? The loss will therefore be substantially greater. You won’t lose any more, though, than what you invest. It cost Stephen $100.

Leverage on the Pocket Option platform

Next to the amount you intend to invest, leverage is listed in the platform’s menu on the right side. Consider that not all assets have the same level of leverage. It will also be different if you open a transaction at a different time.

Remember that leverage is another extremely effective instrument. It can help you lose much more money than you invest, just as it may help you gain much more money than you invest. Take cautious when using leverage, especially if you’re just getting started.