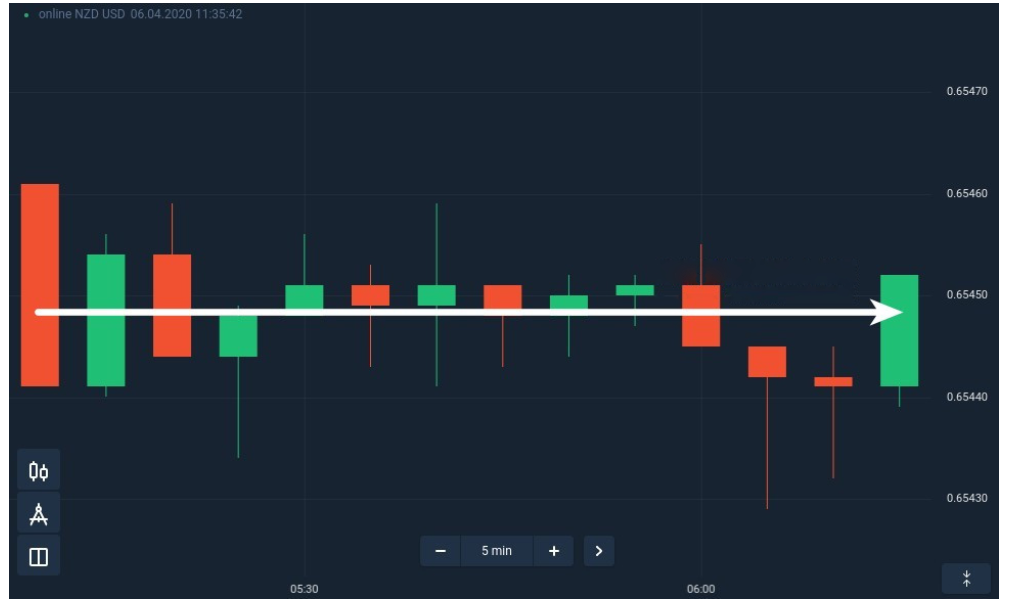

The market is always evolving. The biggest adjustment is made to the movement of this change. You may say the market is flat if there is no upward or downward movement but only sideways movement. And that final circumstance is what many traders fear will happen.It is well recognized that a flat market is a terrible location to start fresh deals. Although one might benefit from both upward and negative trends, a flat market does not offer many possibilities.

It is good to stay away from trading when the market is flat

But, a trader can accomplish a ton of things as they wait for the market to pick up steam. To give you a basic idea of how to make the most of this waiting period, I’ll discuss a few today. In reality, you should value this time since it is valuable. Typically, when the market is trending, you might not have enough time to make any significant modifications and examinations. What can you then do?

Evaluation of your results

A crucial tool that every trader should use is a trading log. This is an exhaustive record of every transaction you made and every activity related to it. So, you ought to mention the market conditions at the market’s opening and closing times, the successful and unsuccessful trades, your emotional state, and any other observations you may have.

Even if examining a trade journal could seem like a waste of time on a typical day, you should do it right away. It is crucial to assess the outcomes of your calculations. This will increase your efficiency moving forward.

Basic research

The market is influenced by the political, social, and economic climates. There must therefore be a justification for market consolidation. And it’s your job to conduct some simple study to find it so you can utilize it to forecast future price fluctuations.

It happens frequently that the market falls before significant announcements. Don’t forget to study economic reports and conduct analysis. Checking the reports of the larger corporations, which have the potential to influence how the price behaves on the market, may also be a good idea.

Technical analysis

Doing technical investigation is the last thing I advise doing in this article when the market is flat. Perhaps you’ve disregarded it in the past, or perhaps you were going about it systematically. The problem is that you have time to complete it thoroughly now.

Examine your trading plan. What was successful and what wasn’t. Examine different aspects and technical indicators. Which ones benefit you and which ones can you skip? Your performance in the future can be considerably improved by technical analysis.

Summary

When the market exhibits sideways oscillations, do not be discouraged. There is still a lot you can do, even though it is prudent not to create a new role. Review your previous operations and make good use of this time. They can teach you a lot of things.

So maintain your composure and head to the action. Concentrate, read, and gain knowledge.