Introduction

Facts About Olymp Trade. In today’s fast-paced world, online trading has gained immense popularity as a means to generate income and build wealth. One such platform that has been making waves in the online trading industry is Olymp Trade. In this article, we will closely examine Olymp Trade and provide a detailed overview of its features, benefits, risks, and challenges. We will also discuss how to use Olymp Trade, tips for successful trading, and compare it with other trading platforms. So, if you’re interested in learning more about Olymp Trade and its intricacies, let’s dive in!

What is Olymp Trade?

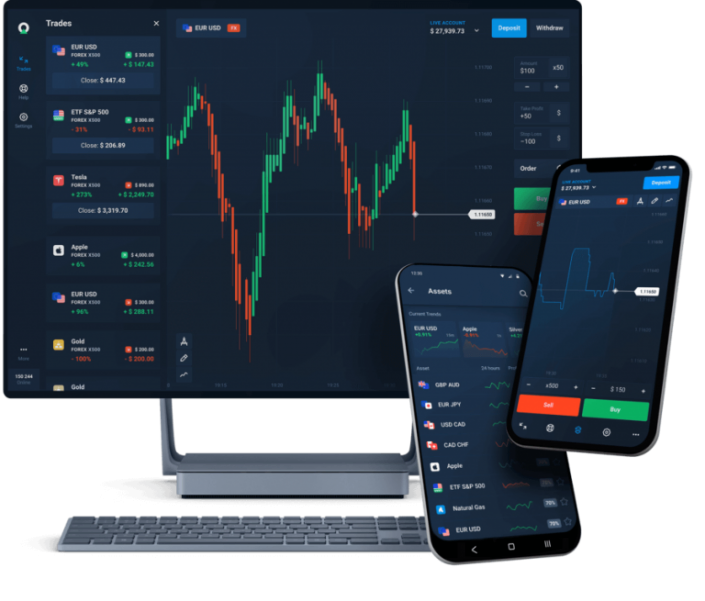

Olymp Trade is an online trading platform that provides an opportunity for individuals to trade various financial instruments such as currencies, stocks, commodities, and cryptocurrencies. It is a user-friendly platform that allows traders to speculate on the price movement of these instruments and make profits based on their predictions. Olymp Trade is known for its simple and intuitive interface, making it accessible to both beginners and experienced traders.

History of Olymp Trade

Olymp Trade was established in 2014 and has since grown into a reputable online trading platform. The company behind Olymp Trade is Smartex International Ltd., which is registered in St. Vincent and the Grenadines. Over the years, Olymp Trade has achieved several milestones and received numerous awards for its outstanding performance and commitment to customer satisfaction.

Features of Olymp Trade

Olymp Trade offers a range of features that make it a popular choice among traders. Some of the key features of Olymp Trade include:

- User-friendly interface: Olymp Trade has a simple and intuitive interface that is easy to navigate, making it accessible to traders with varying levels of experience.

- Wide range of trading instruments: Olymp Trade offers a diverse range of financial instruments to trade, including currencies, stocks, commodities, and cryptocurrencies. This allows traders to diversify their investment portfolio and take advantage of different market opportunities.

- Free demo account for practice: Olymp Trade provides a free demo account with virtual funds for traders to practice their trading skills and strategies without risking real money. This is a valuable feature for beginners to gain experience and confidence before trading with real funds.

- Quick and secure deposit/withdrawal options: Olymp Trade offers various deposit and withdrawal methods that are fast, secure, and convenient. Traders can choose from a wide range of options, including bank cards, e-wallets, and cryptocurrencies.

- Educational resources and customer support: Olymp Trade provides a wealth of educational resources, including tutorials, webinars, and market analysis tools, to help traders improve their knowledge and skills. Additionally, the platform offers responsive customer support via live chat, email, and phone, ensuring that traders have access to assistance when needed.

- Mobile trading platform: Olymp Trade has a mobile app that allows traders to trade on the go, providing flexibility and convenience. The app is available for both Android and iOS devices and offers full functionality for trading and managing positions.

How to Use Olymp Trade

Getting started with Olymp Trade is easy. Here is a step-by-step guide on how to use Olymp Trade:

- Account registration and verification process: To start trading on Olymp Trade, you need to create an account by providing your email address and password. Once registered, you need to verify your account by submitting the required documents for identity verification.

- Fund deposit and withdrawal methods: Olymp Trade offers various deposit and withdrawal methods, including bank cards, e-wallets, and cryptocurrencies. Choose a method that suits your preference and follow the instructions to deposit funds into your trading account.

- Types of trading instruments and their usage: Olymp Trade offers a wide range of trading instruments, including currencies, stocks, commodities, and cryptocurrencies. Each instrument has its own characteristics and requires different strategies. Familiarize yourself with the different instruments and their usage before placing trades.

- Placing trades and managing positions: Olymp Trade allows you to place trades by predicting the direction of price movement of a chosen instrument. You can choose from different trade types, such as classic options, digital options, and forex. Once a trade is placed, you can monitor your positions in the “Open Trades” section of the platform and manage them accordingly, such as setting stop loss and take profit levels, adjusting trade size, and monitoring the performance of your trades.

- Utilizing trading tools and resources: Olymp Trade provides a range of trading tools and resources to help traders make informed decisions. These include technical analysis tools, market indicators, economic calendars, and educational resources such as tutorials, webinars, and market analysis.

- Managing risks and setting a trading strategy: Successful trading requires managing risks and having a well-defined trading strategy. Olymp Trade encourages traders to use risk management tools such as stop loss and take profit orders, and to develop a trading strategy based on their individual goals, risk tolerance, and market analysis.

- Monitoring and analyzing performance: To improve your trading performance, it’s essential to monitor and analyze your trades regularly. Olymp Trade provides a comprehensive trade history section that allows you to review your past trades, analyze your performance, and identify areas for improvement.

Tips for Successful Trading on Olymp Trade

Here are some tips to enhance your trading experience on Olymp Trade:

- Educate yourself: Learning about different trading instruments, strategies, and market analysis techniques can significantly improve your trading skills. Take advantage of the educational resources provided by Olymp Trade, such as tutorials, webinars, and market analysis tools.

- Practice with a demo account: Before trading with real money, use the free demo account provided by Olymp Trade to practice your trading skills and test different strategies without risking your funds. This can help you gain confidence and experience before trading with real money.

- Develop a trading plan: Having a well-defined trading plan is crucial for success in trading. Define your goals, risk tolerance, and trading strategy, and stick to your plan consistently. Regularly review and update your trading plan based on your performance and market conditions.

- Use risk management tools: Managing risks is an essential aspect of trading. Use stop loss and take profit orders to limit your losses and secure your profits. Avoid overtrading and risking more than you can afford to lose in a single trade.

- Monitor market trends and news: Stay updated with the latest market trends, economic news, and events that may impact the financial instruments you trade. This can help you make informed trading decisions and capitalize on market opportunities.

- Control emotions: Emotions can influence trading decisions, often leading to impulsive and irrational actions. Stay disciplined and control your emotions, such as fear, greed, and impatience, to avoid making hasty decisions that can result in losses.

- Diversify your portfolio: Avoid putting all your eggs in one basket by diversifying your investment portfolio. Trade different financial instruments and spread your risks across different markets, sectors, and asset classes.

Risks and Challenges of Trading on Olymp Trade

Like any form of trading, trading on Olymp Trade also involves risks and challenges that traders need to be aware of. Some of the risks and challenges of trading on Olymp Trade include:

- Volatility and market risks: Financial markets are volatile, and the prices of financial instruments can fluctuate rapidly, resulting in potential losses for traders. Traders need to be prepared to handle market risks and have a risk management strategy in place.

- Limited regulatory oversight: Olymp Trade is registered in St. Vincent and the Grenadines, which has less strict regulatory oversight compared to other jurisdictions. This can pose risks in terms of investor protection, dispute resolution, and transparency. Traders should be cautious and conduct thorough research before trading on Olymp Trade.

- Lack of guarantees and guarantees of returns: Trading on Olymp Trade involves speculative trading, and there are no guarantees or assurances of returns. Traders should be aware that trading involves inherent risks, and there is always a possibility of losing money in the market.

- Psychological challenges: Trading can be emotionally challenging, and traders may experience fear, greed, and other emotions that can affect their decision-making process. It’s essential to develop emotional resilience and discipline to make rational trading decisions.

- Technical challenges: Trading on a digital platform like Olymp Trade requires technical skills and familiarity with the trading tools and resources provided. Traders need to be proficient in using the platform and understanding the technical indicators and analysis tools.

- Lack of knowledge and experience: Lack of knowledge and experience in trading can pose risks as traders may make uninformed decisions or fall for scams. It’s important to educate oneself about trading concepts, strategies, and risks before diving into the market.

- High leverage risks: Olymp Trade offers leveraged trading, which can amplify both profits and losses. Traders need to be cautious when using leverage and ensure that they understand the risks associated with it.

Conclusion

Facts About Olymp Trade. In conclusion, Olymp Trade is a popular online trading platform that provides opportunities for traders to engage in various financial markets. It offers a user-friendly interface, a wide range of financial instruments, and educational resources to help traders make informed decisions.

However, it’s important to remember that trading involves risks, and it’s essential to approach it with caution and develop a well-defined trading plan. Traders should be aware of the risks and challenges associated with trading on Olymp Trade, such as market volatility, limited regulatory oversight, psychological challenges, technical challenges, lack of knowledge and experience, and high leverage risks.

By following best practices, such as educating oneself, practicing with a demo account, developing a trading plan, using risk management tools, monitoring market trends, controlling emotions, and diversifying the portfolio, traders can improve their chances of success on Olymp Trade.

If you’re interested in trading on Olymp Trade, make sure to conduct thorough research, seek professional advice if needed, and always trade responsibly. Remember that trading involves risks, and it’s important to trade within your risk tolerance and financial capabilities.

FAQs (Frequently Asked Questions)

- Is Olymp Trade a regulated trading platform?

Olymp Trade is registered in St. Vincent and the Grenadines and does not have the same level of regulatory oversight as some other jurisdictions. Traders should be aware of the limited regulatory protection and conduct thorough research before trading on Olymp Trade.

- Can I trade on Olymp Trade without any prior experience?

While Olymp Trade provides educational resources, it’s recommended to have a basic understanding of trading concepts and risks before starting to trade. Lack of knowledge and experience can pose risks in trading.

- What financial instruments can I trade on Olymp Trade?

Olymp Trade offers a variety of financial instruments, including stocks, cryptocurrencies, commodities, digital options, and forex.

- Can I lose money while trading on Olymp Trade?

Yes, trading involves risks, and there is always a possibility of losing money in the market. Traders should be prepared to handle market risks and develop a risk management strategy.

- What are the risk management tools available on Olymp Trade?

Olymp Trade provides risk management tools such as stop loss and take profit orders that allow traders to limit their losses and secure their profits.