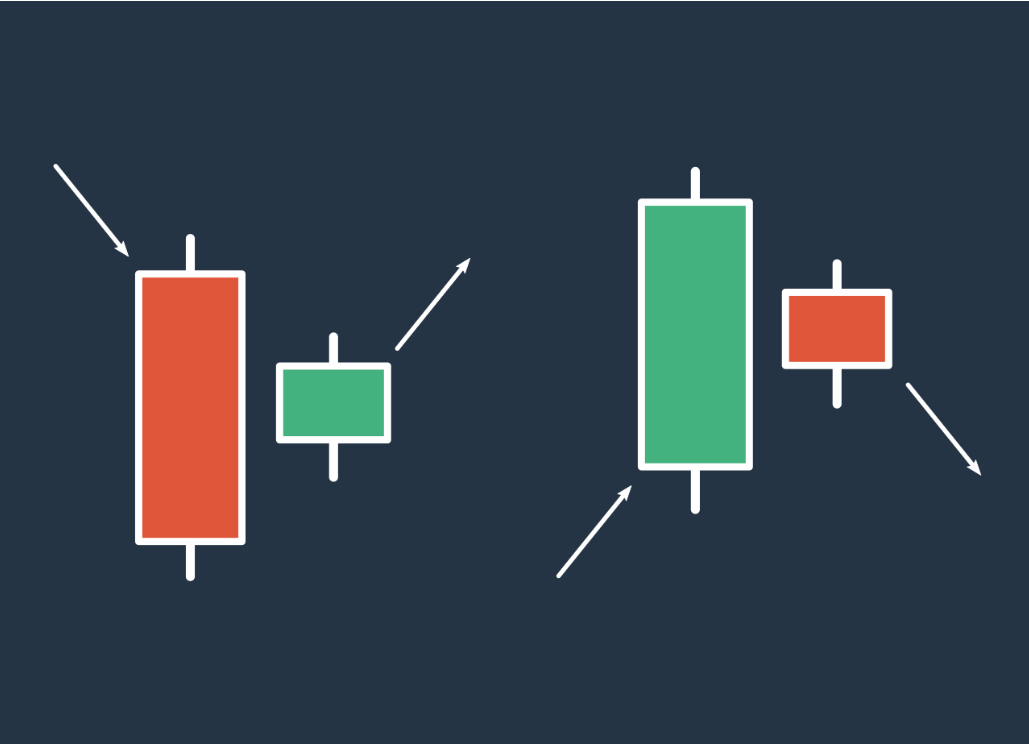

The Harami pattern can be seen on the Japanese candlestick chart. Its name translates to “woman giving birth to a child” in Japanese. It appears to be two candles, one big and one small, placed side by side. A trend might be poised to change, according to the pattern.

The Harami pattern is composed of two candles, as I already mentioned. Typically, it predicts that the present trend will terminate.

When the trend is up, the first Harami candle is long and green; when it is down, it is long and red.

The second bastard candle is the opposite color from the first and is smaller. Accordingly, the candle will be brief and red during an upward trend and brief and green during a downward trend.

Harami Pattern Reading

It appears that the trend is for the candles to be the same color. The strength of the trend is shown by a long candle. The trend may be about to alter, though, if a candle of a different color arrives. This candle of the opposing color in the Harami pattern is considerably smaller than the candle that came before it. In most cases, it is also inside the body of the preceding thing. There is a very good chance that the trend will change after you observe Harami candles. The second possibility is that the price must decrease before the market turns around and moves in the original direction.

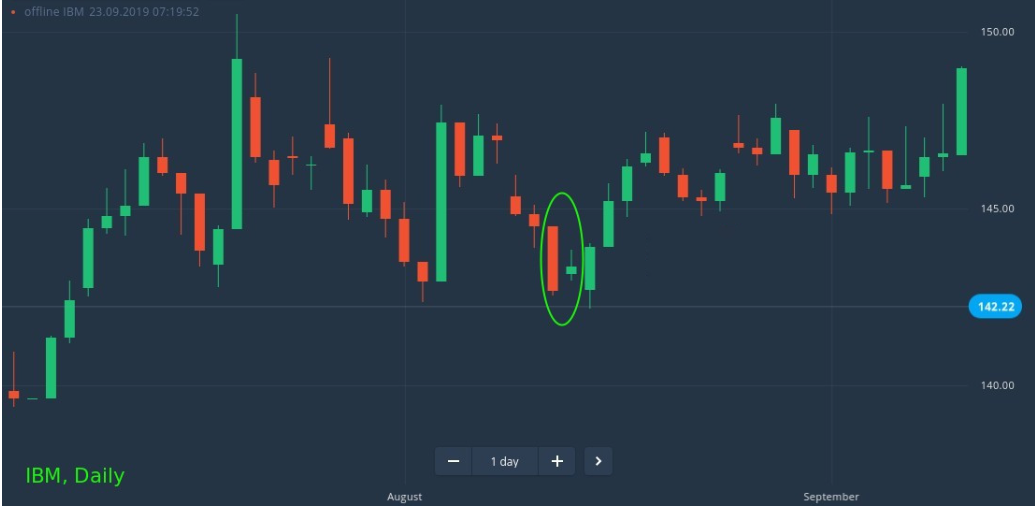

Trading with the Harami Pattern on the Pocket Option Platform

The mentioned pattern is best employed for longer term trading because it is challenging to determine whether the Harami candles indicate a trend change or a price correction. The time period used in the chart above is one day. When the third green candle begins to rise is the ideal time to enter the position. That candle makes it obvious that the trend will increase. There should be a day between trades.

It’s time to put the Harami pattern to work now that you’ve learned everything there is to know about it. Before spending real money, test it out using the free Pocket Option sample account. There is no risk-free way to do this, therefore exercise extreme caution while making trades. You will almost certainly lose money. Be ready to deal with situations that don’t always go as planned.

Do not hesitate to contact us. Enter your remark in the space provided here.