Pocket Option Winning Strategy. Are you new to trading and looking for a winning strategy to help you make profitable trades on Pocket Option? Trading on Pocket Option can be challenging, especially for beginners who are still learning the ropes. However, with the right strategy, you can significantly increase your chances of making profitable trades. In this article, we’ll take a closer look at Pocket Option winning strategies and show you how to analyze markets and identify opportunities to make successful trades.

Introduction

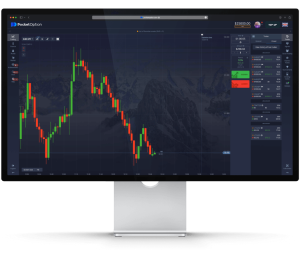

Pocket Option Winning Strategy. Pocket Option is an online trading platform that offers traders the opportunity to trade a wide range of assets, including stocks, commodities, cryptocurrencies, and forex. One of the keys to successful trading on Pocket Option is having a winning strategy. A winning strategy involves analyzing the markets, identifying opportunities, and developing a trading plan that can help you make profitable trades.

Understanding Market Analysis

Market analysis is the process of examining the financial markets to identify potential trading opportunities. Market analysis involves examining economic, financial, and other quantitative and qualitative factors that could impact the price of a particular asset. By analyzing the markets, traders can identify trends, patterns, and opportunities that can help them make profitable trades.

Types of Market Analysis

Pocket Option Winning Strategy. There are two main types of market analysis: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves examining the underlying economic and financial factors that could impact the price of an asset. This includes analyzing macroeconomic indicators such as GDP, inflation, and interest rates, as well as microeconomic factors such as earnings, revenue, and market share. Fundamental analysis is often used by long-term investors who are interested in the long-term growth prospects of an asset.

Technical Analysis

Technical analysis involves examining charts and other technical indicators to identify trends, patterns, and opportunities. Technical analysts use charts to identify support and resistance levels, trends, and other patterns that can help them make profitable trades. Technical analysis is often used by short-term traders who are interested in making quick profits.

Identifying Market Opportunities

To identify market opportunities, traders need to analyze the markets and identify trends, patterns, and opportunities that could lead to profitable trades. Here are some of the key factors to consider when analyzing the markets:

Trend Analysis

Trend analysis involves examining charts to identify trends in the price of an asset. Traders can use trend analysis to identify whether an asset is in an uptrend, downtrend, or sideways trend. By identifying trends, traders can make informed decisions about when to enter and exit trades.

Support and Resistance Levels

Support and resistance levels are price levels at which an asset has historically struggled to break through. Traders can use support and resistance levels to identify potential buying and selling opportunities. For example, if an asset is approaching a resistance level, traders may look to sell the asset, whereas if an asset is approaching a support level, traders may look to buy the asset.

Indicators and Oscillators

Indicators and oscillators are mathematical calculations that can help traders identify potential trading opportunities. Some of the most commonly used indicators and oscillators include moving averages, Relative Strength Index (RSI), and Stochastic Oscillator.

Candlestick Patterns

Candlestick patterns are a type of chart pattern that can provide traders with valuable information about the price action of an asset. Candlestick patterns can help traders identify potential buying and selling opportunities based on the formation of the candlesticks.

Developing a Winning Trading Strategy

To develop a winning trading strategy, traders need to consider a range of factors, including their goals, trading style, risk management, and trading psychology.

Setting Realistic Goals

One of the first steps in developing a winning trading strategy is to set realistic goals. Traders should identify their financial goals, such as the amount of profit they hope to make, and develop a trading plan that can help them achieve these goals.

Choosing the Right Trading Style

Traders also need to choose the right trading style for their goals and risk tolerance. Some traders prefer to take a long-term approach, while others prefer to make quick profits through short-term trades. Traders should choose a trading style that suits their goals and risk tolerance.

Risk Management

Risk management is an essential part of any trading strategy. Traders need to identify the risks associated with each trade and develop a risk management plan to mitigate these risks. This may involve setting stop-loss orders, limiting leverage, or diversifying their portfolio.

Trading Psychology

Trading psychology is another critical factor in developing a winning trading strategy. Traders need to be disciplined, patient, and able to manage their emotions when trading. By maintaining a positive trading mindset, traders can increase their chances of making profitable trades.

Conclusion

Pocket Option Winning Strategy. In conclusion, developing a winning trading strategy on Pocket Option requires a combination of market analysis, identifying opportunities, and developing a trading plan that suits your goals and risk tolerance. By following the steps outlined in this article, traders can increase their chances of making profitable trades on Pocket Option.

FAQs

- What is Pocket Option?

- What is market analysis?

- What is technical analysis?

- What is risk management?

- How can I develop a winning trading strategy?

What is Pocket Option?

Pocket Option is an online trading platform that allows traders to trade a wide range of assets, including stocks, commodities, cryptocurrencies, and forex.

What is market analysis?

Market analysis is the process of examining the financial markets to identify potential trading opportunities. This involves analyzing economic, financial, and other quantitative and qualitative factors that could impact the price of a particular asset.

What is technical analysis?

Technical analysis is a type of market analysis that involves examining charts and other technical indicators to identify trends, patterns, and opportunities.

What is risk management?

Risk management is the process of identifying and managing the risks associated with trading. This may involve setting stop-loss orders, limiting leverage, or diversifying a portfolio.

How can I develop a winning trading strategy (Pocket Option Winning Strategy)?

To develop a winning trading strategy, you need to analyze the markets, identify potential opportunities, and develop a trading plan that suits your goals and risk tolerance. This may involve setting realistic goals, choosing the right trading style, managing your risks, and maintaining a positive trading mindset.