Markets are driven by supply and demand throughout the financial sector. According to the rule of demand, demand and price are inversely related. Because consumers do not want to spend a lot of money on a product, demand declines as prices rise. But as the price drops, there is a huge demand since people are ready to acquire. According to the rule of supply, supply and price are inversely correlated. Due to sellers’ reluctance to sell at such low prices, there is a low supply when the price is low. Yet, supply also rises when prices are high because retailers seek to maximise their profits.

These basic rules of supply and demand apply. Let’s now examine how to trade on Kotex by utilising supply and demand zones in the markets.

Recognizing Supply and Demand Zones on Kotex

Broad areas of support and resistance levels can be used to identify supply and demand zones. However, their underlying assumptions are different. Support and resistance levels are effective because they are connected to previously observed peaks and bottoms by market participants. For supply and demand, cheap or expensive is more important. Supply and demand are established at the support and resistance levels, respectively.

Look for longer candles that develop later to locate supply and demand locations. The next step is to determine what caused the sudden change in price, which is typically a lateral movement.

Trade with supply and demand zones on the Kotex platform

Typically, when a price enters the demand zone, it means that momentum is moving in the right direction. This indicates that you ought to start a purchase position. Employ the Kotex platform’s currency pairs (CFDs) rather than fixed-time trades. Don’t forget to place the stop loss immediately below the area of demand (or above the supply area for sell positions).

Typically, the price will decrease quickly as it reaches the supply zone. You should therefore enter briefly.

Occasionally the supply sector turns into the demand sector, and vice versa. Similar to how support and opposition roles alternate, this happens.

The concepts of supply and demand are numerous. Let’s examine some of the most typical in more detail.

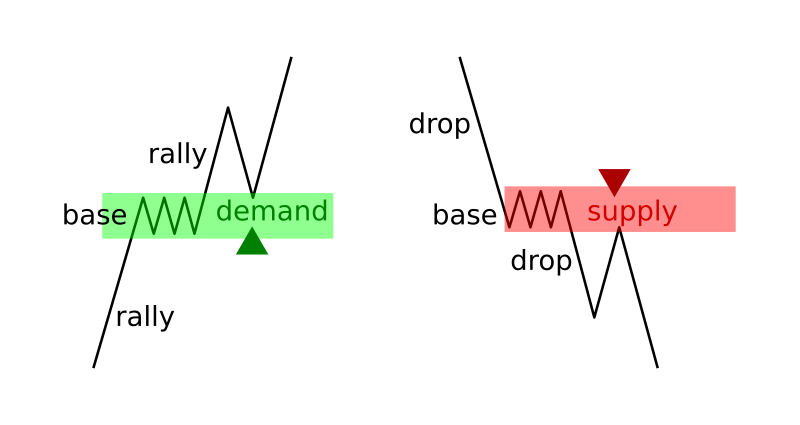

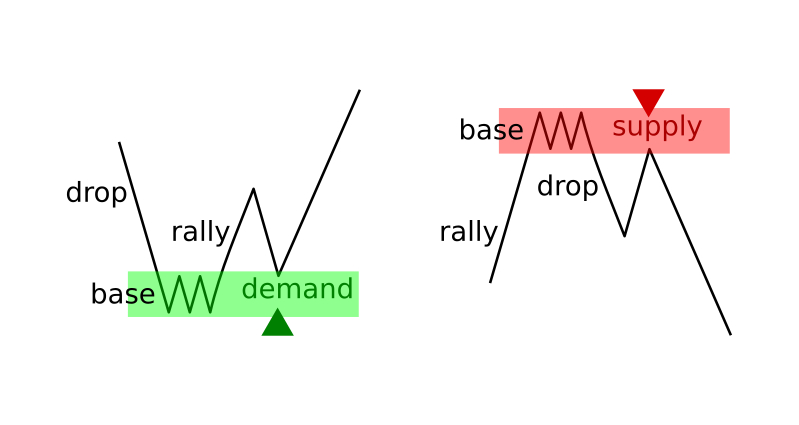

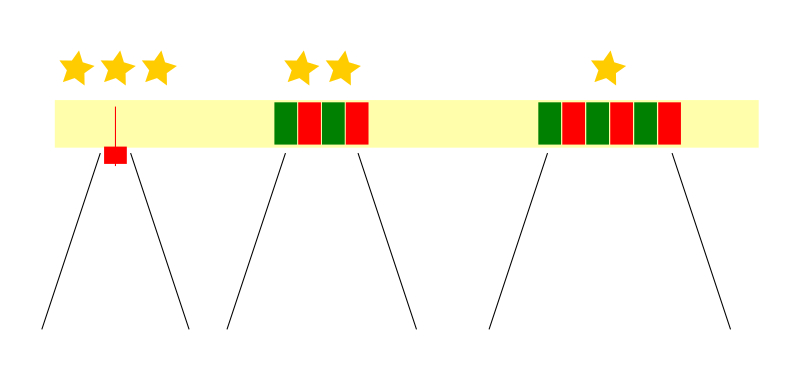

trend continuation pattern

Trend continuation patterns can be produced by supply and demand. This happens when a price is increasing, fluctuations to create a base level, and then resumes its upward trend. Hence, a demand area has been developed. As the price rallies back to the demand level, you should open a long position.

The pattern develops when the price falls into a base during a downtrend, then breaks out and continues to fall. When the price has returned to the supply area following the bounce, start a sell trade.

trend reversal pattern

When the price reverses following an upswing and movement within the base, a supply reversal pattern forms. You ought to start a SELL transaction here for that reason. Enter when the price is retracing the supply zone that has just developed.

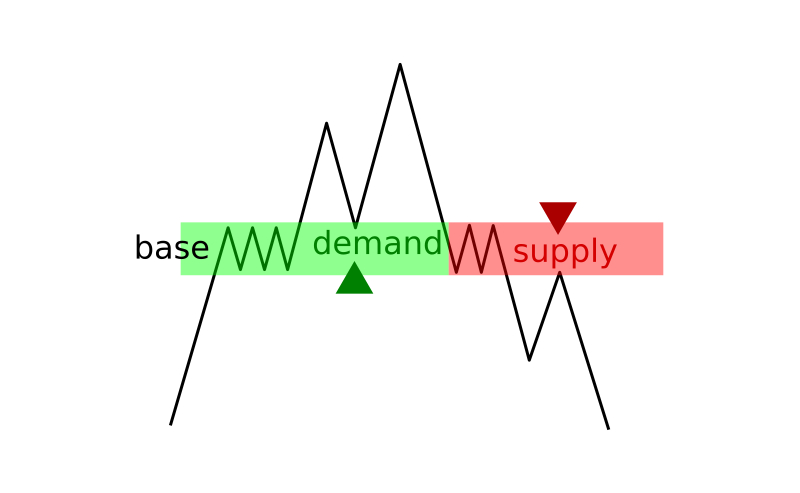

flip zone

We refer to the situation in which supply exceeds demand as the flip zone. There will eventually be a limit to the supply and demand zones. When the price leaves the zone and climbs, this happens. By doing this, the price may occasionally establish a new basis for a fresh supply/demand pattern. The zone’s function can then be said to have altered.

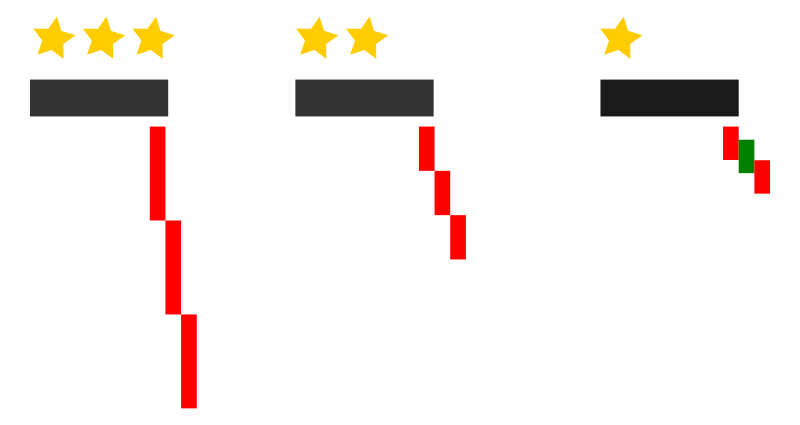

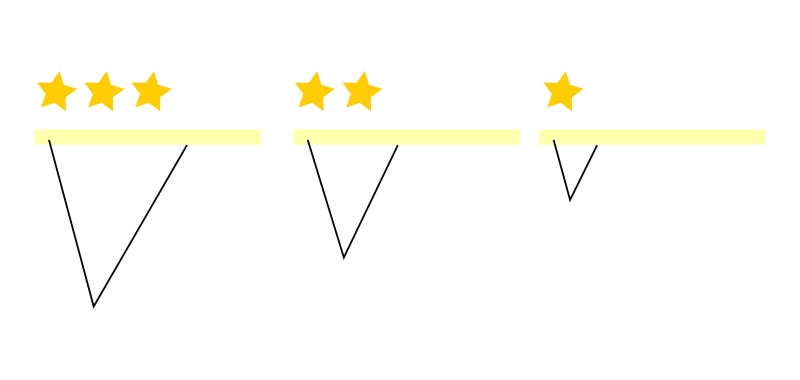

How strong is demand and supply

The type of candles that emerge when these levels are broken can be used to determine the strength of demand and supply. Long candles of the same colour indicate extremely high demand or supply when the price moves abruptly up or down. Zones are regarded as strong even though the candles are middling in length and occasionally retraced. The price is trending weakly as a result of inadequate supply or demand.

The amount of time spent in the zone is another indicator of how strong a level is. In this situation, the length of time required by supply or demand is inversely related to the field’s strength. A supply or demand overshoot is evident by how little time is left in the zone.

The time it takes for a price to change from supply or demand to demand and back again reveals information about how strong the levels are. When the price strays too far before turning around, a level is powerful.

The level deteriorates each time the price retraces. The zone is strongest when a price first touches either supply or demand. The following time, it is still comparatively powerful, but with each successive price return, it becomes weaker.

Using the demand and supply areas to enter trading positions on Kotex

You must first determine the areas of supply and demand. Discover them sooner rather than later.

Seeing how the levels are accepted in the time frame you wish to trade is the next step.

Wait for a signal from the price activity and then enter the trade as necessary.

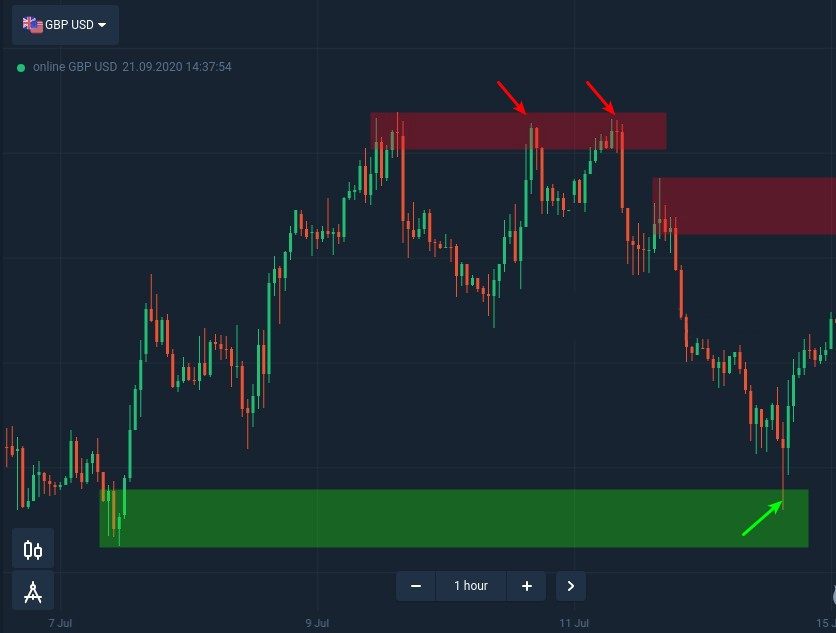

Below is an illustration of the GBP/USD currency pair’s one-hour time frame.

You should enter a trading position when you see a strong demand or supply area.

Summary

All financial markets are built on the principles of supply and demand. You can utilise this information to locate the ideal entry opportunities for your trades by understanding the universal principles that apply to them. The best you can expect for with any technique is that it reduces risk and increases your chances of success, which is not a guarantee that every trade you make will be profitable.

With a demo account, practise determining supply and demand levels. It is provided by Quotex free of charge, along with virtual money.

In the comments box below, please share your experiences trading with supply and demand zones on the Quotex platform.