The fundamental skill of recognizing support and resistance is the foundation of the rectangular pricing pattern. You can get steady returns from it within a constrained trading window. With the help of this advice, you should be able to identify the pattern and use it effectively when trading on Quotex.

How to recognize the rectangular price pattern

Let’s talk for a moment about the ranging market. The prices are rising to a certain point just to fall to another specific point. A higher price creates a resistance level and the lower provides support. They are strong enough so after the price reaches them, it just bounces back without breaking a resistance or support.

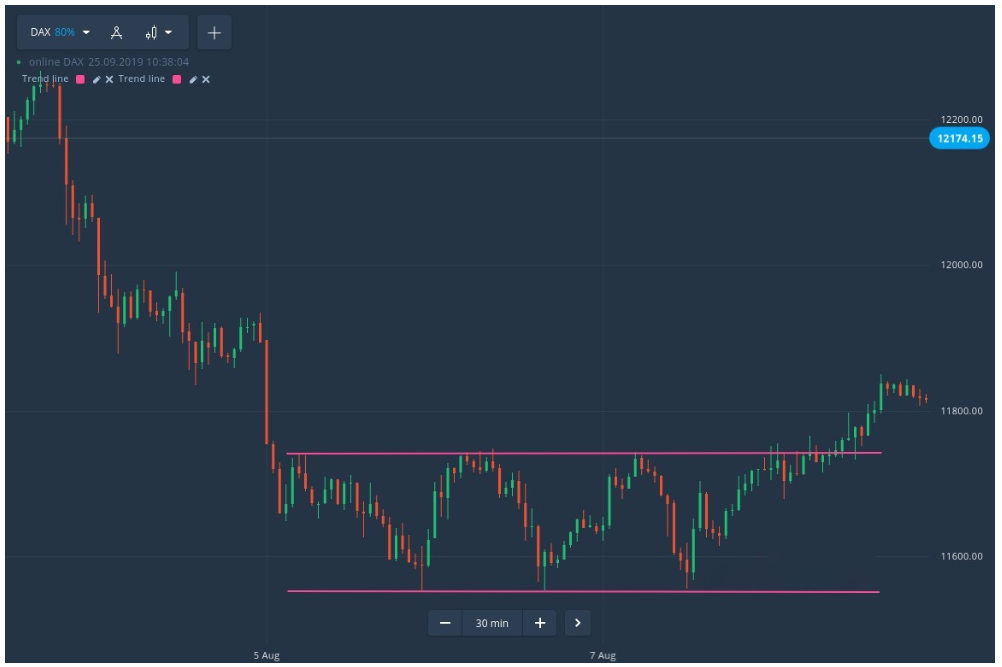

The support and resistance are created by adding lines that are parallel to each other. The support line will be created by joining at least two bottoms. The resistance line will connect at least two tops. Take a look at the 30-minute DAX chart below.

The rectangle pattern is noticeable when the trend is going to an end. It suggests a change in the trend direction.

So the moment when you can spot price consolidation will be at the top of an upward trend or the bottom of a downward trend. And what it is saying is that the directional movement has been finished and the trend is ready to reverse. At this time, prices do not exceed or fall below a certain level.

What to do when the rectangular price pattern appears

The pricing boxes pattern is typically simple to spot once it has emerged. But don’t be alarmed. Prior to the start of the new trend, you could still be able to turn a profit from it.

You should draw the lines of support and resistance first. Watch for the times when the price crosses the lines then. Open a buy position when it crosses the support line. Open a sell position if the resistance line is touched.

When trading short-term deals, we advise using the chart with a broad time frame. Open 5-minute transactions if, for instance, the chart you are trading on is a 30-minute chart. In this way, you can be confident that the price will remain within the rectangle and won’t rise before the trade expires.

What to do when the price overcomes the support or resistance level

You need to get ready for when the price will break through the support or resistance level. It will happen eventually. After the breakout, keep an eye on the price’s direction and trade accordingly.

You should open a buy position if the price breaches the resistance level, as shown in our example chart below, as this signals the start of an uptrend.

In this tutorial, you can find more information on trading following a price breakout.

The price fluctuates up and down within a specific range during the duration of the price boxes pattern. Finally, the barrier is broken when the price momentum is quite strong. There are some signs that point to this happening. For instance, the candles are the same color and longer. You are therefore entitled to assume that the market will continue to move in the breakout direction.

Taking into account everything said above, you can enter the trade in response to a changing trend.

You can use the rectangle price pattern now that you are aware of it. Use a free demo account to get some practice before switching to a paid Quotex account. Be mindful at all times that this tactic is not a foolproof recipe for achievement. Since risk can never be totally eliminated while interacting with the financial market, you will probably experience losses.

Tell us about your experience. www.mYpese.com

FAQS

- What are rectangular price boxes?

Rectangular price boxes are a technical analysis tool that helps traders identify support and resistance levels in a price chart. They are formed by drawing horizontal lines at the top and bottom of a range of prices where the price has consolidated or traded within a confined area. - How do I trade rectangular price boxes on Quotex?

To trade rectangular price boxes on Quotex, you can use them to identify potential entry and exit points for your trades. When the price breaks out of a rectangular price box, it can indicate a potential trend reversal or continuation, and you can use this information to make informed trading decisions. - How do I draw rectangular price boxes on Quotex?

To draw a rectangular price box on Quotex, you can use the drawing tools available on the charting platform. First, select the rectangular price box tool, and then click and drag your mouse to draw the box around the area where the price has consolidated. - Can I use rectangular price boxes for all types of assets on Quotex?

Yes, you can use rectangular price boxes for all types of assets on Quotex, including stocks, currencies, commodities, and cryptocurrencies. - How do I interpret the information provided by rectangular price boxes?

Rectangular price boxes can provide information about support and resistance levels, potential trend reversals, and market volatility. Traders use this information to make informed trading decisions, such as identifying entry and exit points for their trades. - Are there any risks associated with trading rectangular price boxes?

Yes, there are risks associated with trading rectangular price boxes, just like any other trading strategy. Traders should always use risk management techniques, such as stop-loss orders, to minimize their losses and protect their capital. - How can I learn more about trading rectangular price boxes on Quotex?

Quotex offers educational resources, such as articles, videos, and webinars, to help traders learn about different trading strategies, including rectangular price boxes. You can also consult with a trading mentor or join a trading community to gain insights and knowledge from other experienced traders.