The Inside Bar pattern introduction

The swings of the price on the chart are the basis for price action trading. The candlesticks frequently form recurring patterns that can be used to forecast the direction of future prices. One such pattern is the inside bar pattern, which I shall outline for you today.

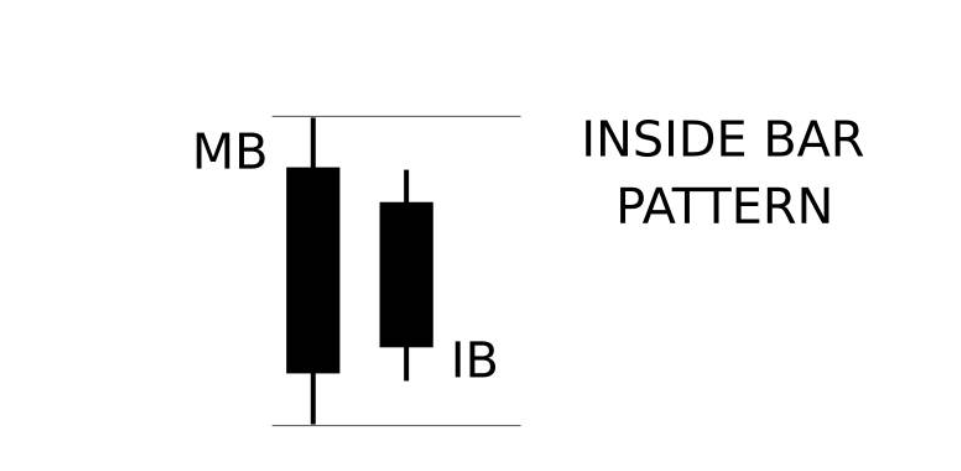

The inside bar design consists of two price bars. The main rule is that the second bar should be inside the first one, with the high lying lower and the low higher than the first bar. It may be put in the center, at the base, or at the top.

Most traders believe the information above to be accurate. The likelihood that the lows or highs of the two candles are equal is acknowledged by some, nevertheless.

The Mother bar, often known as MB, and the Inner bar, are the two bars in the pattern (IB).

The price consolidation period is shown by the inside bar. Such a delay frequently follows a forceful motion. The prior course of action is then taken. Trend reversals can occasionally be traded using the inner bar pattern. For these occasions, you should mix it with the support and resistance levels.

Inside Bar pattern

Trading with the inside bar pattern at Quotex

The inside bar pattern can be traded in a few different ways. Nonetheless, the next two are the most frequently employed.

When the market is trending, the inside bar pattern is the first strategy to apply. You follow the trend when trading. A “breakout play” or a “inside bar breakout” may be used as phrases.

Trading against the trend constitutes the second strategy, commonly referred to as an inside bar reversal. After then, it is traded from significant price levels (support or resistance).

Pending orders are typically placed by traders at the low or high of the Mother bar. Let’s examine entry points for your trades in more detail.

Trading the inside pattern along with the trend on the Quotex platform

Opening a sell position during the downtrend

When the market is downtrending and you are trading with the trend, you should open a sell position using the inside bar pattern. Then, it is referred to as a “inside bar sell signal.” Utilize this approach while trading currency pairs (CFDs), though you might also be able to do so when utilizing fixed-time trades. You place the pending order near the bottom of the Mother bar, right below the candle’s Low value, to initiate a transaction.

Inside bar in a downtrend

Opening a buy position during the uptrend

The market is in an upswing when you get a “inside bar purchase signal.” The high of the Mother bar, right above the High value, should represent the location of your pending order.

Strong trends will definitely cause you to observe a lot of inside bar patterns, which will give you lots of opportunity to enter the trade.

Trading the inside pattern against the trend on the Quotex platform

Opening a sell position with the inside bar pattern and resistance level

The EURUSD chart is shown below with the resistance level highlighted. During the rally, the inside bar pattern emerged on the resistance line. You should start a sell position since you trade in the other way. In this situation, you can also sell at a price just below Mothers Low by using a pending order.

Opening a buy position with the inside bar pattern and support level

A support line is marked on the other currency pair chart for the NZDUSD. On this crucial level, the inside bar pattern has formed, signaling a trend reversal. Open a buy position, please. Once more, you can use a pending order to set a purchase order right above the Mother bar’s High value.

When the inside bar pattern emerges on the important price levels, a powerful move frequently follows. This increases your likelihood of making money.

Final instructions to trade with the inside bar pattern

It’s common to hear the recommendation to “trade with the trend.” It is advised to trade the inside pattern in addition to the current trend in this instance, particularly if you are just starting out in trading. Reversals trading is a little more challenging and takes some trading expertise.

A 5-minute or higher chart time period is the ideal one for using the inner bar pattern. Use it with 3-minute candles, not 1-minute ones. You’ll receive a lot of false signals with such a short time frame.

On occasion, a few Inner bars will appear following the Mother bar. There may be one, two, or even four candles. Each will be a smaller size than the one before it. They tell about a lengthier period of consolidation. The breakthrough that follows is frequently quite strong.

Keep an eye out for the inner bar patterns that appear after the outer bar patterns. It is crucial that you can recognize various patterns on the chart because they frequently provide false signals.

In the beginning, try identifying the inside bar pattern on your Quotex sample account. Choose the markets that are trending and trade in step with the trend. While using actual money, exercise extreme caution because this tactic does not always result in success. Be ready to deal with losses, particularly early on.

Comment on the inside bar method in the space provided below the website.

Here are some frequently asked questions (FAQs) about identifying and trading the Inside Bar pattern on Quotex:

- What is an Inside Bar pattern?

An Inside Bar pattern is a two-bar pattern where the second bar is completely contained within the range of the previous bar. It is a sign of consolidation and can indicate a potential upcoming breakout. - How do I identify an Inside Bar pattern on Quotex?

To identify an Inside Bar pattern on Quotex, look for two bars where the second bar has a lower high and a higher low than the first bar, and is completely contained within the range of the first bar. - What are some common trading strategies for the Inside Bar pattern on Quotex?

Some common trading strategies for the Inside Bar pattern on Quotex include trading the breakout of the pattern in the direction of the trend, or placing a stop order above the high or below the low of the Inside Bar and waiting for a breakout. - How can I confirm a breakout of the Inside Bar pattern on Quotex?

To confirm a breakout of the Inside Bar pattern on Quotex, look for a strong move in the direction of the breakout accompanied by high trading volume. - What are some risks associated with trading the Inside Bar pattern on Quotex?

One risk associated with trading the Inside Bar pattern on Quotex is that false breakouts can occur, resulting in losses. It is important to use risk management techniques such as stop-loss orders to minimize potential losses. - Can I use the Inside Bar pattern in combination with other technical analysis tools on Quotex?

Yes, the Inside Bar pattern can be used in combination with other technical analysis tools on Quotex, such as trend lines, moving averages, and oscillators to confirm trading signals. - How can I improve my ability to identify and trade the Inside Bar pattern on Quotex?

To improve your ability to identify and trade the Inside Bar pattern on Quotex, it is important to practice and gain experience, and to stay informed about market news and events that may impact trading. You can also use demo trading accounts to practice your strategies without risking real money.