In compliance with the requirements of both the international Anti Money Laundering rules and the KYC policy (Know Your Customer), user data verification is a required procedure (Anti Money Laundering).

We are required to track user activity and identify users by offering brokerage services to our traders. Verification of identity, the customer’s residential address, and email confirmation make up the system’s fundamental identification requirements.

email address verification

Upon registration, you will get a confirmation email (from Pocket Option) with a link you must click to validate your email address.

Click “Profile” and then “Profile” to access your profile if you haven’t already received the email.

And to send a second confirmation email, click the “Resend” button in the “Identification Details” block.

Send a message to [email protected] using the email address you use on the Platform if you don’t receive a confirmation email from us, and we will manually validate your email.

Identity Verification

After you enter your identity and address information in your profile and submit the necessary papers, the verification procedure will start.

Locate the Identity Status and Address Status sections on the Profile page after opening it.

Note: Please note, you must enter all personal and address information in the Identity Status and Address Status sections before uploading the document.

For identification verification, we accept scanned or photographed images of a passport, a local ID card, and a driver’s licence (both sides). The photographs can be dropped or clicked into the appropriate areas of your profile.

The image of the document must be in colour, uncropped (all of the document’s edges must be visible), and high resolution (all information must be clearly visible).

Example:

After the photos have been uploaded, a verification request will be made. An expert will react to your support case, where you can monitor the status of your verification.

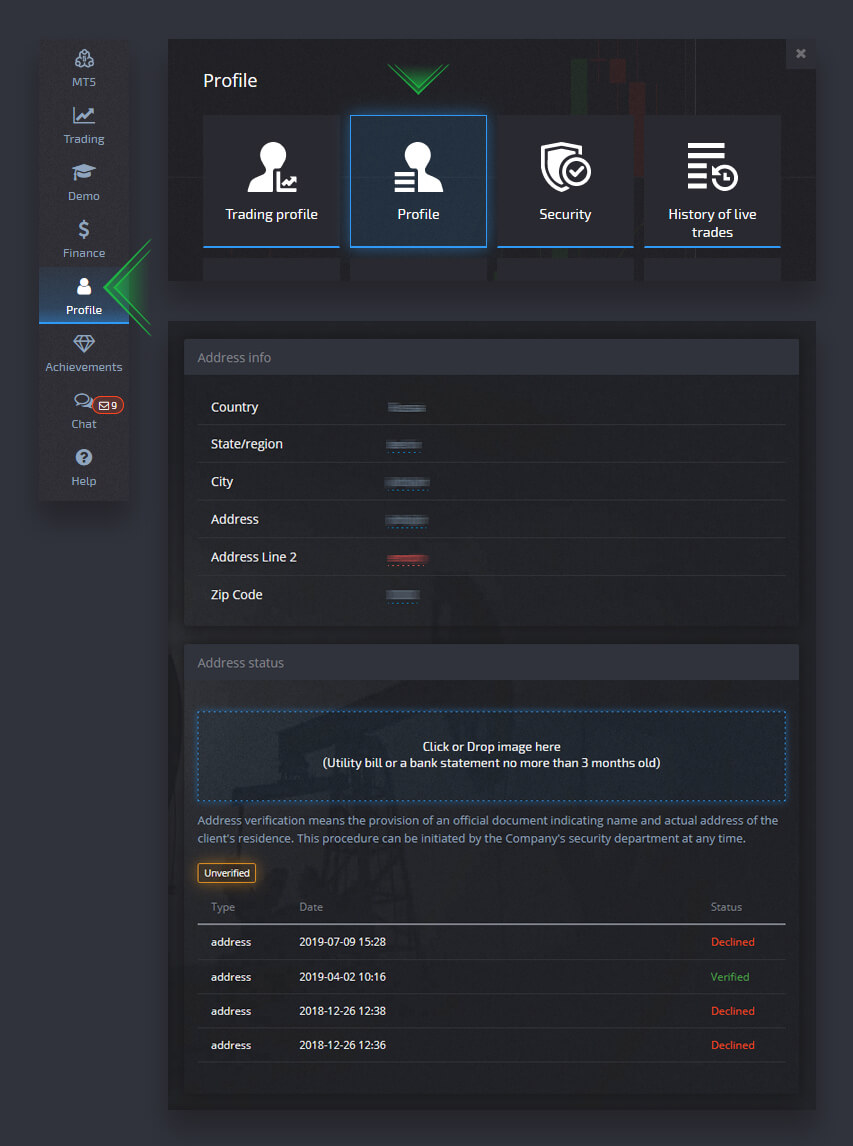

address verification

The verification procedure starts once you fill out your profile with your identification and address details and upload the necessary supporting documentation.

Locate the Identity Status and Address Status sections on the Profile page after opening it.

Note: Please note, you must enter all personal and address information in the Identity Status and Address Status sections before uploading the document.

Each field needs to be filled out (except “Address Line 2” which is optional). We accept paper-issued proof of address documents that were issued in the account holder’s name no more than three months ago for address verification (utility bill, bank statement, address certificate). The photographs can be dropped or clicked into the appropriate areas of your profile.

The file image for the document must be uncropped, high-resolution, and in colour (all edges of the document are clearly visible and uncropped).

Example:

After the photos have been uploaded, a verification request will be made. An expert will react to your support case, where you can monitor the status of your verification.

bank card verification

While using this technique to request a withdrawal, card verification is possible.

Open the profile page after creating the withdrawal request and look for the “Credit/Debit Card Verification” section.

You must upload scanned images (photos) of the front and back of your bank card in the appropriate parts of your profile (Credit/Debit Card Verification) in order to get your card verified. Please avoid only covering the first and final four numbers in the future. Make sure the card is signed and that the CVV code on the back is covered.

Example:

A verification request will be created after the procedure has started. You can use that request to monitor the status of the verification or to get in touch with our support staff.